Curriculum

Personal Finance and Wealth

About The Personal Finance and Wealth

0/5Starting Course

0/3Module 1: Introduction to Personal Finance

0/3After Intro

0/3Course Resources

0/0Case Studies

0/2Setting Financial Goals

Welcome to Lesson 1.2 of our “Mastering Personal Finance and Wealth Building” course. In this lesson, we’ll delve into the critical process of setting financial goals. Goals are like the roadmap to your financial success – they provide direction and purpose to your financial journey. Whether you dream of buying a home, sending your children to college, or retiring comfortably, setting clear and achievable financial goals is the first step towards turning your dreams into reality.

Learning Objectives.

By the end of this lesson, you will be able to

- Understand the importance of setting specific, measurable, achievable, relevant, and time-bound (SMART) financial goals.

- Identify personal financial goals based on individual values, aspirations, and life circumstances.

- Learn how to prioritize and categorize financial goals to create a comprehensive financial plan that aligns with your long-term vision for financial success.

Why are financial goals important?

Imagine you’re setting out on a cross-country road trip. Would you embark on the journey without a destination in mind? Of course not. Similarly, financial goals give your financial journey a purpose and direction. They help you stay focused, motivated, and accountable.

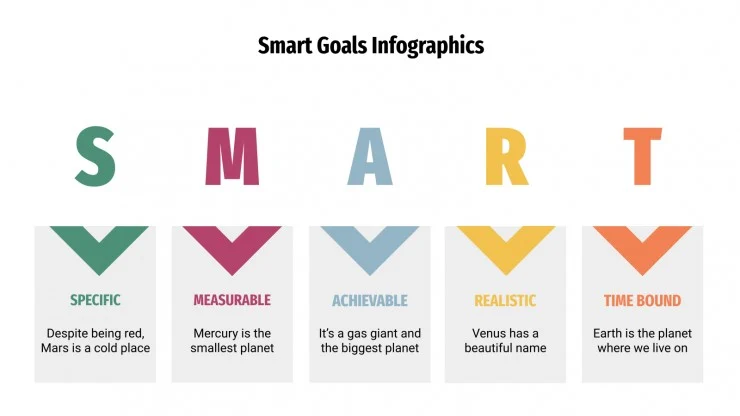

The SMART Goal Framework: Setting effective financial goals involves using the SMART framework. SMART stands for Specific, Measurable, Achievable, Relevant, and Time-bound.

- Specific: Your goal should be clear and well-defined. Instead of saying, “I want to save money,” specify, “I want to save $10,000 for a down payment on a house.”

- Measurable: Make your goal quantifiable. You should be able to track your progress. In our example, you can measure your progress by checking your savings account.

- Achievable: Ensure that your goal is realistic and attainable. Setting an unattainable goal can lead to frustration and disappointment. Make it a challenge but not impossible.

- Relevant: Your financial goal should align with your overall life plan. It should be relevant to your values and long-term aspirations.

- Time-bound: Set a deadline for achieving your goal. A timeline adds a sense of urgency and helps you stay on track. For example, aim to save $10,000 within three years.

Types of Financial Goals: There are different types of financial goals:

- Short-term goals: These are goals you plan to achieve within the next year or less. Examples include building an emergency fund or paying off credit card debt.

- Intermediate-term goals: These goals have a timeframe of 1-5 years. They can include saving for a vacation, buying a car, or funding your child’s education.

- Long-term goals: These are goals you aim to achieve in more than five years. They often revolve around major life events like retirement, buying a home, or funding your children’s education.

Steps to Setting Financial Goals: Now, let us explore the steps to setting your financial goals

- Identify Your Goals: What do you want to achieve financially? Be specific and consider both short-term and long-term objectives.

- Prioritize: Not all goals are equally important. Determine which goals are most urgent and align with your values.

- Quantify: Assign a dollar amount to each goal. How much will it cost to achieve each one?

- Set Deadlines: Establish realistic deadlines for each goal. When do you want to achieve them?

- Create an Action Plan: Break down each goal into smaller, manageable steps. What do you need to do to get there?

- Monitor and Adjust: Regularly review your progress and adjust your goals as needed. Life circumstances can change, so flexibility is key.

Conclusion: Setting financial goals is a crucial step in your journey towards financial success. Remember to use the SMART framework to make your goals specific, measurable, achievable, relevant, and time bound. By doing so, you’ll have a clear roadmap to follow, and you’ll be better equipped to make informed financial decisions.

Setting financial goals can be both exciting and empowering. It’s the first step towards taking control of your financial future. So, take some time to reflect on your aspirations, set your goals, and let them guide you on your path to financial well-being.